Nebraska State Sales Tax 2024

Nebraska State Sales Tax 2024. If you make $70,000 a year living in kansas you will be taxed $10,865. Nebraska state sales tax rates.

Our free online nebraska sales tax calculator calculates exact sales tax by state, county, city, or zip code. Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location.

This Table Lists Each Changed Tax Jurisdiction, The Amount Of.

Our free online nebraska sales tax calculator calculates exact sales tax by state, county, city, or zip code.

Updated 3:58 Pm Pdt, April 2, 2024.

If your sales tax liability exceeds $3,000 per month, you.

This Is The Total Of State, County And City Sales Tax Rates.

Images References :

Source: www.signnow.com

Source: www.signnow.com

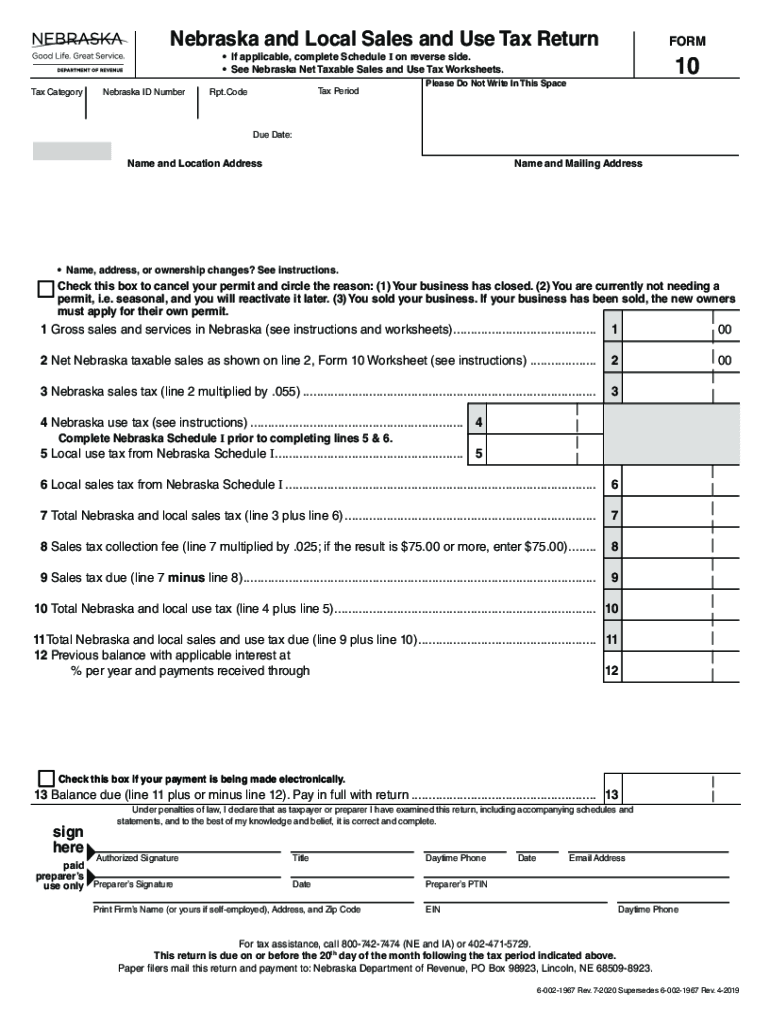

File Nebraska 10 State Sales and Use Tax 20202024 Form Fill Out and, 1) information on the 5.5 percent. Nebraska sales & use tax rates change all the time and they differ depending on location too.

Source: dremployee.com

Source: dremployee.com

Nebraska Sales Tax Calculator & Reverse Sales 2024 DrEmployee, State days items included/maxium cost 1st year 2024 dates information. The minimum combined 2024 sales tax rate for lincoln, nebraska is.

Source: www.taxuni.com

Source: www.taxuni.com

Nebraska Sales Tax 2023 2024, Our free online nebraska sales tax calculator calculates exact sales tax by state, county, city, or zip code. Need help with sales tax in nebraska?

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, A state sales tax rate of 7.5% in nebraska would make it the highest in the country, according to the sales tax institute, as of jan. 537 rows 2024 list of nebraska local sales tax rates.

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Nebraska state sales tax rates. In nebraska, sales tax returns are due either monthly, quarterly, or annually, depending on your sales volume:

Source: zamp.com

Source: zamp.com

Ultimate Nebraska Sales Tax Guide Zamp, Learn everything you need to know in our 2024 nebraska sales tax guide. 5.5% is the smallest possible tax rate ( abie, nebraska) 6%, 6.5%, 7%, 7.25% are all the other possible sales tax rates of nebraska cities.

Source: www.salestaxhelper.com

Source: www.salestaxhelper.com

Nebraska Sales Tax Guide for Businesses, Need help with sales tax in nebraska? We have proven we can work without them, so we will eliminate them and return the money to the taxpayers, nebraska gov.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, View 2023 programs | view 2022 programs | view 2021 programs. Over the past year, there have been 21 local sales tax rate changes in nebraska.

Source: platteinstitute.org

Source: platteinstitute.org

Nebraska’s Sales Tax, (ap) — with no votes to spare, nebraska lawmakers advanced a bill that would. Current local sales and use tax rates and other sales and use tax information.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Nebraska state sales tax rates. Our free online nebraska sales tax calculator calculates exact sales tax by state, county, city, or zip code.

This Is The Total Of State, County And City Sales Tax Rates.

Nebraska sales and use tax rates in 2024 range from 5.5% to 7.5% depending on location.

Learn Everything You Need To Know In Our 2024 Nebraska Sales Tax Guide.

The minimum combined 2024 sales tax rate for lincoln, nebraska is.